Fathom Protocol On A Mission To Innovate DeFi And Amplify The Multi-Trillion Dollar RWA Sector

Liquidity shortage became one of the most troubling concerns facing the blockchain. This prompted the rise of various innovations to tackle the challenge by enhancing liquidity. A notable project that has emerged with potent solutions and a great use case is Fathom Protocolwhich runs on the XDC Network. Besides increasing cryptocurrency liquidity in DEFI, the protocol also has a mission to tokenize real-world assets(RWAs), enforce democratic governance through its native DAO, and foster innovative DEFI investments.

Fathom Protocol has testified its potential to revolutionize the DEFI ecosystem after they recently onboarded Zoth, an onchain marketplace whose mission is providing fixed income opportunities and generous yields by tokenizing real-world assets. One of the products from Zoth is Supply Chain Financing (SFC). According to a news release, Zoth successfully completed two pilots for Supply Chain Financing where each of them made settlements in Fathom Protocol's $FXD.

FXD, a stablecoin issued by Fathom Protocol and running on the XDC Network, aims to address a $5 trillion gap in the trade finance sector.

In an interview on the White Crypto Youtube Channel with CoinsTelegram CEO Anna Tutova featuring three co-founders of Fathom, Anton Grigorev said the tokenomics design of the FXD stablecoin are in such a way that the collateral value exceeds the token's liquidation mechanism (overcollateralization), thereby guaranteeing stability of the stablecoin).

During the interview featuring Tyler Carter, Anton Grigorev and Manuel Rensink, Grigorev also mentioned other FXD features like the stable swap model and adjusted borrowing rates. Fathom Protocol's stable swap model allows DEFI users to exchange stable value assets at affordable fees, while adjusted borrowing rates encourages market price minting of the FXD stablecoin to guarantee affordability when repaying debt on the platform.

To mint FXD, follow the step-by-step process below:

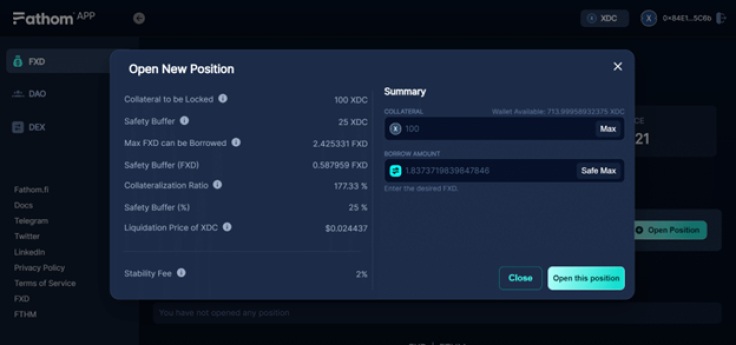

- Create an XDC Network compatible wallet and deposit XDC tokens. These tokens will fund the FXD smart contract to create a Collateralized Debt Position (CDP).

- Visit the Fathom Dapp and utilize the XDC tokens as collateral when borrowing FXD. The collateralization ratio will be 75%. It's good DEFI practice to mint 50% of your holdings to prevent liquidation of your position.

Manuel Resink, a co-founder of Fathom Protocol told Anna Tutova that the FXD team has gone a step farther in implementing overcollateralization compared to most other algorithmic stablecoins which lack backing assets. As such, holders of the stablecoin need not to worry that FXD will fluctuate in value, also holding the stablecoin will give users access to upto nine lending pools and the opportunity for lenders to accumulate high ROI.

Fathom Protocol will also play a significant role in the RWAs sector by giving users exposure to yield opportunities which they will be able to access through Trade Finance Pools, and RWA Vaults. DEFI investors who have RWA token holdings will also have the chance to use them as collateral to borrow FXD. One major milestone for $FXD and the XDC Network in RWAs is having successfully onboarded InvoiceMate, a project pioneering blockchain-based invoicing. InvoiceMate leveraged the power of XDC-powered TradeFinex in showcasing the potential of effectively acquiring liquidity through tokenization of Real World Assets. TradeFinex is a revolutionary peer-to-peer trade finance platform that utilizes the XDC-Network in facilitating the creation of financial and tradeable instruments between populations of traders.

In the groundbreaking initiative, H & H International LLC, a client of InvoiceMate secured $FXD 100,000 after tokenization of valuable invoice documentation. This milestone underscores the impact of innovating business operations with DEFI features, and FXD's role in catalyzing these changes.

These pilots mentioned in the article are only two of many that have successfully taken place on the XDC Network. The impact of each of them is showcasing how tokenization and fractionalization when implemented in Real-World Assets can foster growth and efficiency in investments and business operations. On the other hand, $FXD which is overcollateralized by XDC's utility token facilitated the transactions by funding the pilot's smart contracts. During the interview with CoinsTelegram, the co-founders told Anna they were aware of the compliance requirements and oversight that comes with stablecoins. For this reason, they said they were working with different jurisdictions and regulators so as to grow FXD into a compliant stablecoin. Furthermore, the team also pointed out their plans of implementing jurisdiction-wise DAOs so that each sub-DAO ends up representing its own jurisdiction and an equivalent stablecoin to avoid relying only on the US Dollar. For example, this will result in the birth of Fathom Dirham or Fathom Euro stablecoins. Thereby ensuring that control of the stablecoin market does not rest on the shoulders of a few entities. However, each decision to create a SubDAO and its stablecoin will depend on community voting. As per the co-founders, the community will play a central role in the Fathom Protocol ecosystem and will influence anything from what RWAs to tokenize, yield strategies to implement or what stablecoin to have.

To make all these possible, the main mission is to first amplify liquidity. According to the three, DEFI stagnates without healthy liquidity. As such, the co-founders outlined their plan to amplify liquidity by bringing more staking providers, off-ramps, brokers, exchanges and more custodials to the Fathom Protocol.

Conclusion

Deploying a robust DEFI ecosystem that benefits all stakeholders requires attention to various components including sustainability, affordability and stability. Fathom Protocol has made several implementations to ensure low transaction fees, stability of the FXD token as well as high liquidity. The platform's focus on DAO governance and democratization of decision-making is proof of the team's respect for Web3 ethos and community involvement. They also intend to work out effective protocol management practices and features that are not only innovative but also compliant to the regulatory requirements. Keep watching the space for more updates and developments taking place in the ecosystem.

Market footprint

While writing, the max. supply of FTHM is 1,000,000,000 FTHM coins that are trading at $0.20 USD as per coinmarketcap. Meanwhile,FXD maintains a soft peg to the U.S. dollar, consistently trading at 1 USD. Both tokens are actively available on Fathom DEX, Bittrue and XSwap exchange.

© Copyright IBTimes 2024. All rights reserved.